Financial stability

Improve your financial wellbeing in our exclusive members-only hub. From personalised scores, to weekly tips and bitesize articles, this is your one-stop shop for all things financial stability. And the best bit? You don't even need a loan to access it.

See how it works…

Enjoy monthly updates on your finances and take action if anything changes. Get monthly updates and keep track of your borrowing potential before renewing your membership.

Learn MoreYou don't need to apply for a loan to use our free tools! Become a member and get personalised financial updates. Did we mention that it's free?

Read moreEnjoy monthly updates on your finances and take action if anything changes. Get monthly updates and keep track of your borrowing potential before renewing your membership.

Learn MoreYou don't need to apply for a loan to use our free tools! Become a member and get personalised financial updates. Did we mention that it's free?

Read more

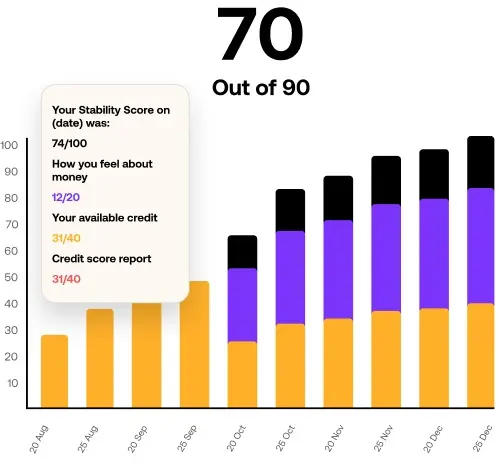

The Spring Score is our newest tool that helps our members achieve their financial goals and track whenever they are the most likely to be eligible for one of our loans.

Discover how financially stable you really are. Calculated from your credit profile and self-reported data, your Stability Score is a unique snapshot of your ability to absorb a financial shock and stay afloat. Check back each month to see your updated personalised score.

Join the Hub

Improve your financial wellbeing in our exclusive members-only hub. From weekly tips to bitesize articles, this is your one-stop shop for all things financial stability. And the best bit? You don't even need a loan membership to access it.

How does a Creditspring membership help a busy mum take back control of her finances? We spoke to... More

How does a Creditspring membership make life easier for a new mum? We spoke to Britney to find ou... More

How does a Creditspring membership help a busy mum take back control of her finances? We spoke to... More

How does a Creditspring membership make life easier for a new mum? We spoke to Britney to find ou... More